which is essentially interest income less interest expense. Ignoring (or adding back) interest expense would therefore unreasonably exaggerate the profitability view of a bank. Important: EV/EBITDA can be a great metric for analyzing a company’s underlying cash flow generation capabilities. However. investors should keep a close eye on earnings as well. and make sure that report EBITDA results turn into shareholder value creation over time. What Types Of Companies Are Best Evaluat Via EV/EBITDA? The obvious answer would be the cable and telecom industry. as that is where the measure originat from in the first place. Telecom is a perfect use case as the firms involv tend to be among the most heavily leverag in the world. spending tens of billions of dollars to build and maintain their networks. amounts of subsequent depreciation and amortization.

That spending also comes with massive

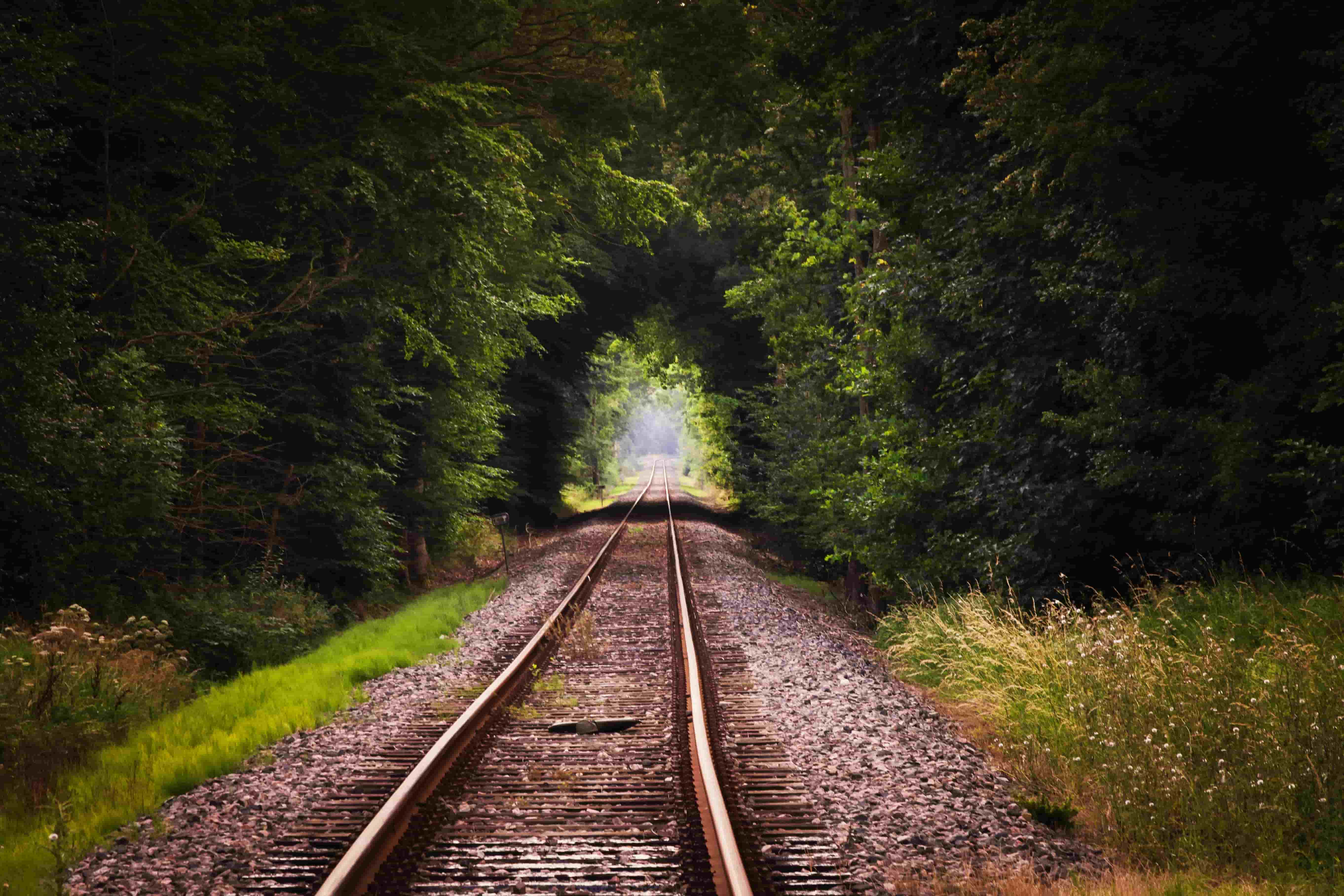

To compare telecom firms allows asia email list investors to get a comparative analysis across different industry participants despite their . fix assets. interest expense and so on. The same principles that apply in telecom also work for many other industries with a large fix asset component. Sectors such as airlines. trucking. and railroads are often analyz using EV/EBITDA since these firms spend heavily on the vehicles which power their businesses. and often have large amounts of debt or financing to fund their operations. EV/EBITDA is also common for companies in basic materials and manufacturing sectors were companies have to invest heavily in their mines. oil wells. chemical plants. factories and so on. These are sunk costs. as the capital to build one of these facilities is already spent.

Vastly different levels of debt

Depreciation of these fix assets can be Latest Bulk SMS a major drag on earnings. However. for investors looking at the cash flow that these already-built assets can provide. EV/EBITDA can prove a much more useful metric than accounting earnings. What Types Of Companies Shouldn’t Be Evaluat Via EV/EBITDA? Investors can get into trouble when using EBITDA to analyze companies where capital expenditures are a large and recurring expense which can’t be paus. For example. with something like a cruise line operator. depreciation is a tremendously real expense. An old cruise ship will no longer be able to attract customers. and at some point. its very seaworthiness would come into question. An investor probably shouldn’t just hand wave away depreciation as a non-cash expense; if a new cruise ship isn’t purchas in a timely manner.